Tesla PE Ratio Historical Chart & Forward Price Earning Ratio

Content

Most would agree the decline is not just macro, as the Twitter distraction and Musk’s political statements are weighing heavily on the price. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. Gear advertisements and other marketing efforts towards your interests. Verify your identity, personalize the content you receive, or create and administer your account. Forward P/E gives some indication of how cheap or expensive a stock is compared with consensus earnings estimates.

Tesla Inc. has a dividend yield of -% with a dividend per share of $- and a payout ratio of -%. (calculated from actual period earnings estimates revision (80% weight) and previous period earnings surprise (20% weight)). pe ratio tesla Provide specific products and services to you, such as portfolio management or data aggregation. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

Growth & Value

Goldman Sachs is now predicting 420k deliveries in the 4th quarter, revised down from 440k. For 2023, they’re saying 1.85M deliveries vs. 1.95M prior estimate. This is not the % YOY of past years but should still be north of 30%. The revenue earned from advertising enables us to provide the quality content you are trying to reach on this website.

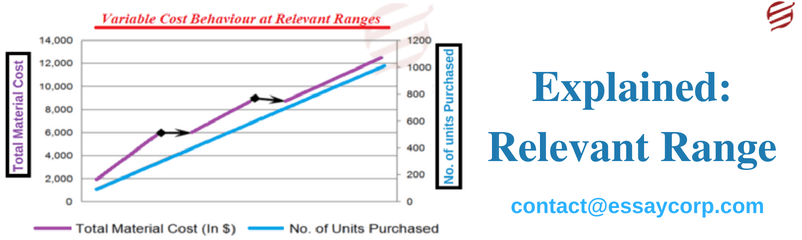

The PE ratio can be seen as being expressed in years, in the sense that it shows the number of years of earnings which would be required to pay back the purchase price, ignoring inflation. So in general terms, the higher the PE, the more expensive the stock is. You can read more about the power of momentum in assessing share price movements on Stockopedia.

Undervalued Renewable Energy Stocks

As a shareholder, you want the company to earn back the price you pay as soon as possible. Therefore, lower P/E stocks are more attractive than higher P/E stocks so long as the PE Ratio is positive. Also for stocks with the same PE Ratio, the one with faster growth business is more attractive.

Tesla’s Earnings per Share for the trailing twelve months ended in Dec. 2022 adds up the quarterly data reported by the company within the most recent 12 months, which was $3.62. Tesla, Inc. is an American company that manufactures and sells electric cars, as well as power storage and photovoltaic systems. The company’s goal is to “accelerate the transition to sustainable energy”. The company name is based on the physicist and inventor Nikola Tesla. For those reasons, I don’t know what the future holds for the company. What I do know though is that as a value investor, the stock is finally looking interesting.

Financial Position

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. The Price to Earnings Ratio is calculated by taking the stock price / EPS Diluted .